Finanace Management

Code for the future of user interfaces & build dynamic, interactive websites to create impactful online experiences.

- 1K Student already enrolled

4.9/5

Course Rating

Join the trending Finance Managment Course today

2-3 Months

Program Duration

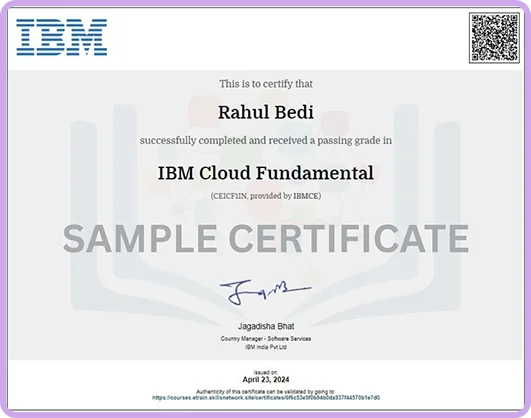

Certifications

2

Industrial Projects

4-6

Internship Partners

100+

Quiz/ Assignments

Lifetime

Program Access

Program Curriculum

Explore a career in web development, a dynamic field that combines creativity and essential skills for a promising professional journey.

Module 1: Introduction to Finance

- Overview of finance and its importance

- Key financial concepts: time value of money, risk and return, financial statements

- Financial markets and institutions

- Understanding different areas of finance: corporate finance, personal finance, investment, and financial planning

Module 2: Financial Statements and Analysis

- Understanding the balance sheet, income statement, and cash flow statement

- Financial ratios and their significance

- Analyzing financial health of a company

- Hands-on: Performing a basic financial statement analysis

Module 3: Time Value of Money

- Present value and future value concepts

- Calculating present and future values of single sums, annuities, and perpetuities

- Discounting and compounding techniques

- Hands-on: Solving time value of money problems

Module 4: Risk and Return

- Understanding risk and return

- Measuring risk: standard deviation, variance, beta

- Portfolio theory and diversification

- Capital Asset Pricing Model (CAPM)

- Hands-on: Calculating risk and return of a portfolio

Module 5: Corporate Finance Basics

- Capital budgeting: Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period

- Financing decisions: debt vs. equity

- Dividend policy and payout ratios

- Hands-on: Evaluating a capital budgeting project

Module 6: Investment Fundamentals

- Overview of investment types: stocks, bonds, mutual funds, ETFs

- Primary and secondary markets

- Understanding stock valuation and bond pricing

- Hands-on: Valuing a stock and a bond

Module 7: Personal Finance Management

- Budgeting and financial planning

- Managing personal debt: credit cards, loans, mortgages

- Basics of retirement planning and savings

- Hands-on: Creating a personal budget and financial plan

Module 8: Financial Markets and Instruments

- Overview of financial markets: money markets, capital markets

- Types of financial instruments: equity, debt, derivatives

- Understanding the role of financial intermediaries

- Hands-on: Exploring different financial instruments

Module 9: Behavioral Finance

- Introduction to behavioral finance

- Common cognitive biases and their impact on financial decision-making

- Behavioral finance in investing and personal finance

- Hands-on: Identifying cognitive biases in financial decisions

Module 10: Capstone Project and Review

- Comprehensive financial analysis project

- Integrating various financial concepts and tools

- Analyzing and presenting financial data

- Final project presentation and critique

- Q&A and troubleshooting

Certificates

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Select the Best Plan for Your Growth

Choose the plan that suits your learning needs and start your journey with Mindenious Edtech today. Tailored options for every goal and budget.

Self Paced

Learn at your own pace

₹ 5,999

- Recorded Sessions

- Hands-on Projects

- Certifications

- Doubt Clear Sessions

- Live Sessions

- Mentor Guidance

- Placement Support

- 1:1 Mentoring

Mentor Led

Guided learning with mentor support

₹ 8,999

- Recorded Sessions

- Hands-on Projects

- Certifications

- Doubt Clear Sessions

- Live Sessions

- Mentor Guidance

- Placement Support

- 1:1 Mentoring

Professional

Be placement ready

₹ 13,999

- Recorded Sessions

- Hands-on Projects

- Certifications

- Doubt Clear Sessions

- Live Sessions

- Mentor Guidance

- Placement Support

- 1:1 Mentoring

Earn credentials from IBM — give the exam, get certified, and stand out.

Master the language of the web with IBM’s globally recognized certification

What You’ll Get:

- IBM digital certificate recognized globally

- Increased trust and credibility with employers

- Better job opportunities and professional edge

- Stronger profile in web development roles

- Proof of your commitment to upskilling

Price : ₹3000

Our Alumni Works At

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.